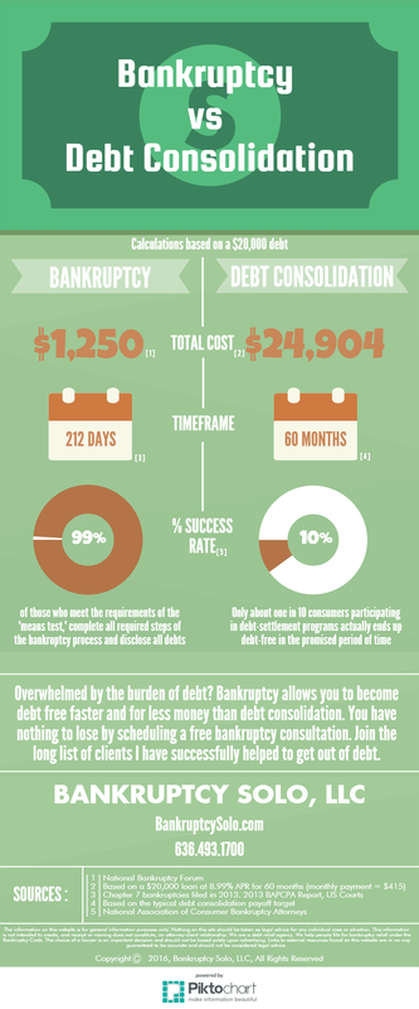

What you do, or don't do, prior to bankruptcy can have a big impact on the success of your bankruptcy. The actions you take prior to filing for bankruptcy can have a potentially irreversible impact on your bankruptcy filing. Here are 7 things to avoid before filing bankruptcy. 1. Provide Inaccurate, Incomplete or Dishonest Information You are required to provide complete and accurate information about all of your assets, debts, income, expenses and financial history. You do so under penalty of perjury. If you knowingly misrepresent your information, such as fail to disclose an asset, you could be subject to criminal prosecution. 2. Rack Up New Debt If you used a credit card to buy a luxury item within 90 days of filing bankruptcy, in an amount exceeding $600, than you may similarly be denied a discharge of that debt. Again, the creditor may file an objection to discharge of that debt, claiming you had no intention to repay it. 3. Move Assets Don't be tempted to sell, transfer for safekeeping, or hide assets before filing bankruptcy. If you do, you might be denied a discharge and even be subject to criminal penalties. 4. Favor One Creditor Over Another If you pay back loans to friends or relatives (within one year of filing), or even other creditors (within 90 days), then this may be considered a “preferential transfer.” The bankruptcy trustee may file an adversarial proceeding to get the money back from the person or entity you paid, and then disburse the money in equal shares across all of your creditors. 5. Fail to File Income Tax Returns Tax returns are crucial to determining your current and past earnings and asset holdings, as well as satisfying potential priority tax claims. 6. Ignore Impending Collection Actions Advise creditors right away of your intention to file bankruptcy. Your attorney may be able to stop attempts to take your property. Without filing there is no protection from creditors. 7. File When You are About to Receive Substantial Assets You should reconsider filing bankruptcy if you are about to receive an inheritance (within one year), a significant income tax refund, a settlement from a lawsuit, or repayment from a loan you made to someone else. In summary, filing for bankruptcy is a complex matter that should not be taken lightly. An attorney can help you to avoid these common mistakes and ultimately help you to get a fresh start. Call a Bankruptcy Attorney at 636-724-3355 or visit www.bankruptcysolo.com to discuss these and other complex legal matters at your free consultation. Overwhelmed by the burden of debt? Bankruptcy allows you to become debt free faster and for less money than debt consolidation. You have nothing to lose by scheduling a free bankruptcy consultation. Join the long list of clients we have successfully helped to get out of debt.

www.BankruptcySolo.com 636-724-3355 When you file for bankruptcy, the “automatic stay” is put into place which effectively stopping creditors in their tracks. This is a United States bankruptcy code law that does not allow creditors or debt collection agencies to take action or file lawsuits against debtors. Not only can the automatic stay protect you against lawsuits regarding the debt that you owe, but it can also shield you from any further collection efforts by creditors, collection agencies, or government entities. In most cases, its reach will extend to foreclosures, auto repossessions, wage garnishments, and debt collections, making it a powerful tool for debtors.

With an automatic stay in place, creditors are prohibited from:

What if a Creditor Violates the Automatic Stay? If a creditor violates the automatic stay by continuing their collection efforts, attempting to seize your property, or garnishing your wages, they can be penalized by the court. Anyone who willfully violates the stay in your bankruptcy case can be held liable for actual damages caused by the violation and, in some cases, even punitive damages. How Long Will the Automatic Stay Protect Me? Generally, the automatic stay will remain in effect for the duration of your bankruptcy case. This means that, as long as you are involved in the bankruptcy process, creditors cannot take action against you. However, this also means that the automatic stay will be lifted once you have received a discharge and your bankruptcy case is closed. How Creditors Can Get Around the Automatic Stay Usually, a creditor can get around the automatic stay by asking the bankruptcy court to remove ("lift") the stay, if it is not serving its intended purpose. For example, say you file for bankruptcy the day before your house is to be sold in foreclosure. You have no equity in the house, you can't pay your mortgage arrears, and you have no way of keeping the property. The foreclosing creditor is apt to go to court soon after you file for bankruptcy and ask for permission to proceed with the foreclosure -- and that permission is likely to be granted. Call The Wibbenmeyer Law Firm, LLC for More Information Stop credit harassment today! Contact a Bankruptcy Attorney at 636-724-3355 or visit www.bankruptcysolo.com to schedule a free consultation with a bankruptcy attorney and find out if you are eligible for bankruptcy. Call today to take your first step to a fresh start! Bankruptcy is not an indicator of financial failure. In fact, according to the Institute for Financial Literacy, frequent causes of financial distress, which ultimately leader to bankruptcy, include unexpected expenses (56 percent), reduction in income (65 percent), job loss (43 percent) and illness/injury (31 percent). You should not feel ashamed about your financial situation, nor should bankruptcy be viewed as an admission of failure. For many, bankruptcy is the most appropriate option for achieving relief from overwhelming debt. Contact The Wibbenmeyer Law Firm, LLC today to schedule a free, no-risk consultation to understand your options and determine if you qualify for a bankruptcy. Take your first step to a fresh start. The Wibbenmeyer Law Firm, LLC is conveniently located in St. Charles, Missouri. 636-724-3355 / www.bankruptcysolo.com.

|

Brandee D. IannelliSt. Charles and St. Louis Bankruptcy Attorney Categories

All

St. Charles and St. Louis Missouri Bankruptcy Attorney |

Call for a Free Consultation (636) 724-3355

RSS Feed

RSS Feed